Liquid Asset

Capital is held in an Australian bank on trust under your name and can be withdrawn at any time.

Not Locked In

We believe our performance should keep you as a client, not long contracts.

Limit Downside

We reduce investors’ risk with smart money management and mathematical models.

Have Impact

We dedicate 10% of our top line revenue to investing in or donating to projects that are positively impacting the planet.

Market Neutral

Our investment is not dependant on the economy doing well or any market going up for our investors to make a profit.

Uncorrelated

Because our trading is proprietary and diversified, our returns are generally not correlated to other investments

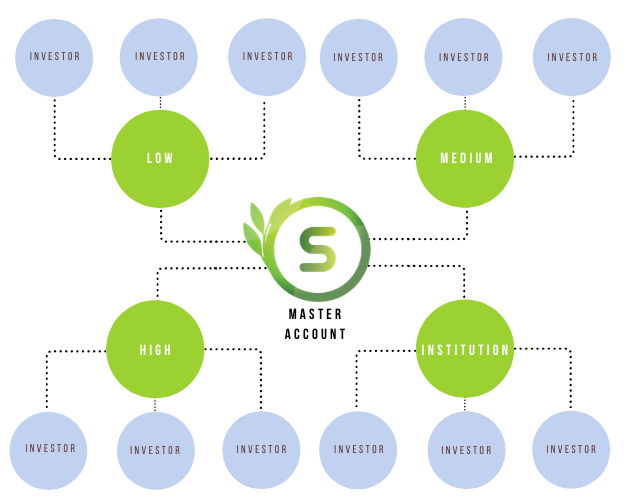

How Managed Discretionary Accounts Work

You set up a trading account and deposit funds with an Australian regulated broker that is approved by us.

You choose which Risk Reward Option you would like and sign the relevant documents.

We connect your account to our system which trades in your account.

You receive monthly reports via email of the investment performance.

The broker deducts our performance fee at the end of the month when the account is in profit.

Algorithm Development Process

1. Design

Our traders and mathematicians plan the trading strategy.

2. Build

Our developers then code the functions of strategy.

3. Backtest

We then run thousands of tests on historical data and analyse it.

4. Paper Trading

The best tests are then run on a demo account using artificial money.

5. Real Funds

We then deploy the trading bot on our own real money.

6. Investor Funds

Only after a bot has passed all prior steps is it made available to investors.

Fees

| Service Fee Type / Description | Amount of Service Fee | ||||

|---|---|---|---|---|---|

| Establishment Fee

The fee to open your account |

Nil | ||||

| Contribution Fee

The fee payable for each amount deposited into your account |

Nil | ||||

| Withdrawal Fee

The fee on each amount you withdraw from your account |

Nil | ||||

| Exit Fee

The fee to close your account |

Nil | ||||

| Switching Fee

The fee for switching Risk Reward Options |

Nil | ||||

| Transaction Fee

The fee for each transaction undertaken on your account charged by Symbiosis Capital |

Nil | ||||

| Third Party Transaction Fee

The fee for each transaction undertaken on your account charged by a Broker or other third party |

Fees may vary depending on the choice of Broker. Some Brokers charge separate fees, and others incorporate their fees into their foreign exchange contract rates. Please refer to the terms of service of the relevant Broker. Note: Our Target Risk Reward Options already incorporate the brokers fees. | ||||

| Performance Fee

The fee for generating a Return on your Account. Fee thresholds are based on Account Equity*. Performance fees become due and payable at the end of each Period. |

|

Frequently Asked Questions

Deposit Currencies

AUD, BTC, CAD, CHF, HKD, JPY, NZD, USD, SGD, GBP, EUR, AED

The choice is completely up to the client as to what you do with the returns at any point in time. We are strong advocates of compounding, and due to the incremental nature of currency trading, the impact of reinvesting can result in a significantly greater outcome at the end of the year. The client can withdraw funds as they wish, though we strongly recommend advising us before doing so as withdrawing large amounts without notice could lead to a significant loss.

We can not because we are not licensed to give financial advice, nor are we interested in giving advice as a business model. We are completely focused on building amazing technology.

Currently we have a limited time offer to open an account with $25,000 (AUD Equivalent), however the account must be brought up to the full minimum balance within a 6 month time frame. Generally our minimum deposit for a client’s account is $50,000 and the client must maintain a balance over this amount at all times. The minimum deposit amount is set at this rate to ensure the account stays within our risk parameters.

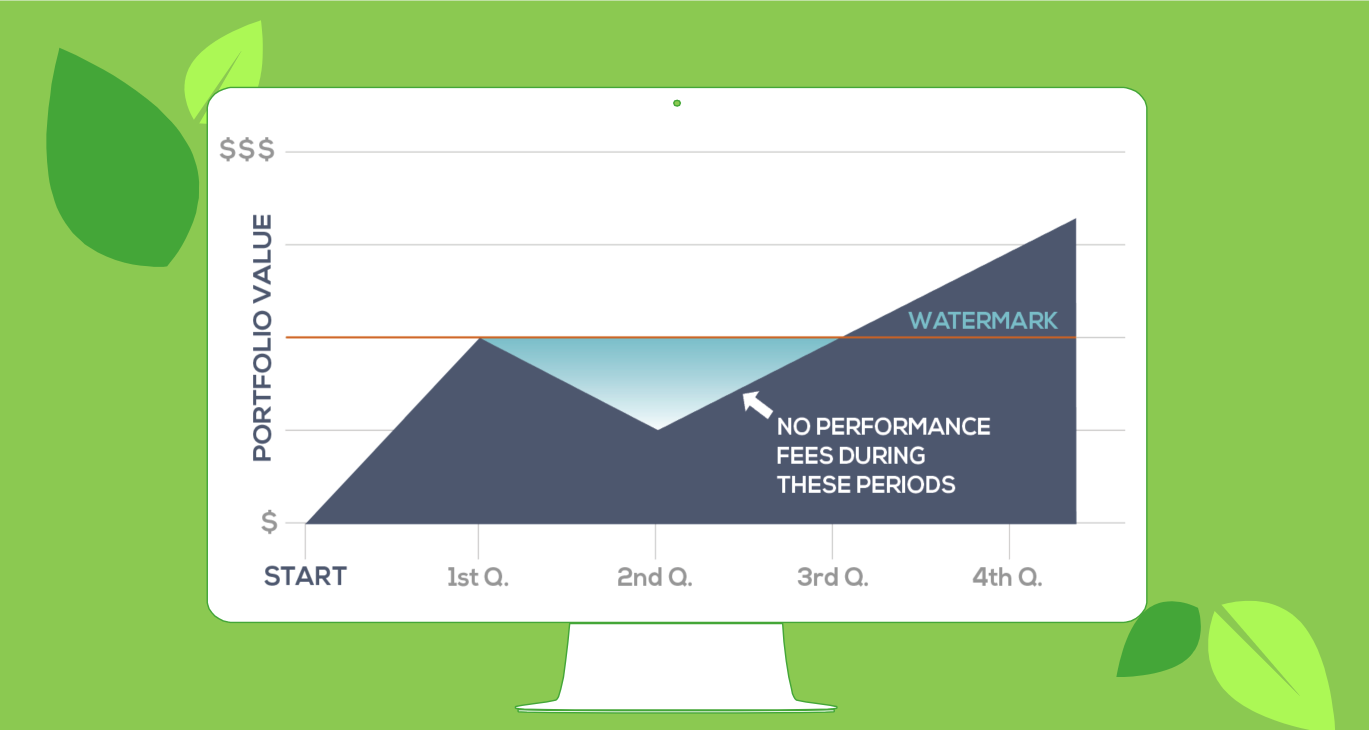

If we incur a loss one month, there is no fee for this period and the next invoice will only become due when the clients’ account has surpassed the last closing balance above the loss. E.g if an account reaches $1,000,000 and is invoiced, then a loss occurs, the next invoice for fees will only be payable when the end of month balance exceeds $1,000,000.

There is not a maximum investment. Our strategy is built to scale and we currently have capacity to deploy another $100 Million without it impacting the returns.

No, we do no charge any other fees other than our performance fees.

We suggest a minimum term of 6-12 months to properly evaluate our performance, though we believe our results should speak for themselves, so there are no lock in contracts.

Our mission is to continually outperform the market, so inherently we get asked this a lot. The results are real and we are transparent with our results and try to manage expectations as best we can.

Human error and carelessness is the main reason accounts get compromised. We use multiple tier access for all logins. Only select staff have access to all areas of our software. We also have software to deter and stop would be hackers. We take the security of our accounts very seriously and have adopted best practices.

During our onboarding process the client signs an agreement that allows their broker to automatically deduct our performance fees from their account at the start of each month for fees payable on the previous month. Symbiosis then issues the client an invoice marked as paid.

No, if we incur a loss one month, there is no fee for this period and the next invoice will only become due when the clients’ account has surpassed the last closing balance above the loss. E.g if the total balance reaches $1,000,000 and the performance fee is invoiced, then a loss occurs, the next invoice for fees will only be payable when the end of month balance exceeds $1,000,000.

Symbiosis doesn’t directly provide reports. The client receives monthly reports from their broker including information relating to specific trades along with profit and loss for a period.

The client has full control over all funds in the accounts at all times to add, withdraw and transfer between accounts. We do however request that if a client wants to withdraw they notify us first as we may be mid trade and it could result in a loss if they withdraw at the wrong time.

Trading algorithms are designed based on the way humans trade, except they have one big advantage, they don’t have emotions which cause poor judgement. In saying this we don’t just let the trading bots run. They are supervised by humans and a number of alerts are in place incase something is out of order.