Some people incorrectly believe that to be a profitable trader, you need to be right all the time and that’s not possible. Well this is an incorrect assumption. Even some of the world’s best traders are not right all of the time. In fact, some of them have been profitable for 20 years and they’ve been right less then 50% of the time. So, how is that possible you might say? Well if you’re right 50% of the time, but when you win you win $2 every time you win and when you lose you lose $1, you now add your risk to reward ratio and your win to loss ratio that I’ll talk about more in a moment to produce an output. That output is either a profitable strategy or a losing strategy. Another misconception is that your take profit or your reward needs to be greater than what amount that you lose with each trade. But this is also incorrect.

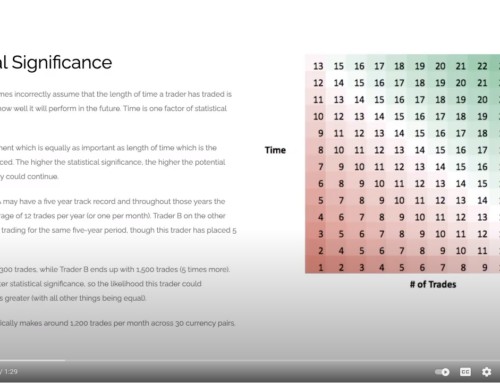

We have some very profitable trading strategies that when they win, they only win $1. And when they lose, they can lose $10. You might say that’s crazy. How could that possibly be profitable? Well if you have a 99% win rate and you have a hundred trades, you’re winning $99 and then when you lose, you lose $10. When it comes to win to loss ratio, this table walks through the win to loss ratio. How many winning trades versus how many losing trades equals the winning percentage? All the winning percentage really means is that it has as a higher probability of hitting the take profit instead of the stop loss more often than not. And here you can see we have the win to loss ratio plus the risk to reward ratio in one table. So, if you look down the bottom left-hand corner, you’ll see it says “poor trader: they’re not profitable.”

So, this means that they have a low risk to reward ratio, meaning that for every time they win, they might win $1. For every time they lose, they might lose $3. And at the same time, they have a low win to loss ratio, meaning that less than 50% of the time they’re winning. This in combination makes an unprofitable trader. And most traders are unprofitable because their wins are usually smaller than their losses and they don’t have a trading strategy that gives them an edge over the market. In the middle blue section, you’ll see we have “good trader”. This is usually a combination of having a decent win to loss ratio, meaning that maybe 55% of the time their trades are profitable and 45% they’re losing. This combined with a decent risk/reward ratio, which may be for every time they lose, they lose $1. And for every time they win, they win a $1.50 Or a $1.20. This type of trader can be profitable over the long term though, you’ll typically see more peaks and troughs in their monthly returns.

Up on the top right-hand corner, you’ll see “professional trader” in green, which are very profitable. Now it’s extremely difficult to get up into this portion of the table because to do so, you have to have a really high win to loss ratio, meaning that you might have a 70 plus percent win rate. So, for every seven trades that you win, you only lose three. And at the same time, for every trade you win, you might win $3, $4, or $5. And for every trade that you lose, you lose only a dollar. This is what some people refer to as the holy grail of trading and very few people ever reach this level. So, hopefully you can see that trading is not about being right a hundred percent of the time. Trading is a game of probability and the more we can stack the probability in our favor, the more likely we’ll have a profitable outcome.

Leave A Comment