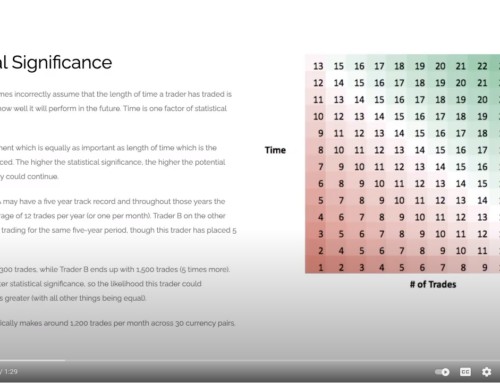

One of the main reasons why many traders don’t make it to be continually profitable is because they don’t understand the recovery risk and the risk per trade. If you look at the table on the right, what you’ll see is that in the first column, you’ve got the loss that is incurred on an account.

And the second column, it’s the percentage gain that’s required to get back to breakeven. If you lose 10%, you need to make gains of 11% to get back to breakeven, but it compounds. Look, if you lose 20%, you now need to make back 25% return to get back to breakeven. If we jump down to 50%, if you’ve lost 50% of your trading equity, you now need to make a gain of 100% to get back.

This is why most traders never make a successful career in trading is because they don’t understand this, so they might place a trade and they might risk 5% or 10% on a given trade and when they lose, now, they have to make back a lot more than what they just lost just to get back to breakeven. This is why managing the risk per trade is vital to the success of any trading strategy over the longterm.

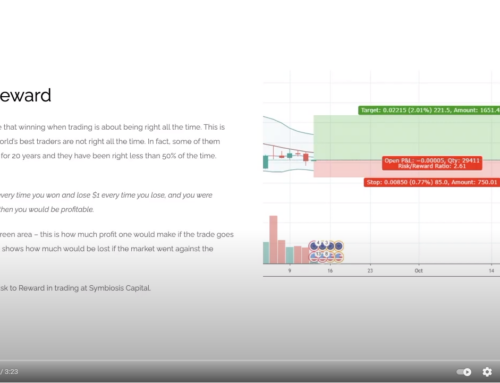

At Symbiosis Capital, we reduce the recovery risk by keeping our risk per trade low. If you do your own research, you’ll find that most professional traders agree the maximum risk per trade should be 2% of the account. This means that when there is a losing trade, the total dollar amount that’s lost will not exceed 2% of the total account balance. Because we trade around 30 currency pairs with multiple trading strategies, it allows us to keep our risk per trade much lower. Our maximum risk per trade is typically less than 1%. In most cases, below half a percent, depending on the risk reward option that’s chosen by the client.

The risk per trade is also related to how smooth the equity curve of the trader is. The smoother the equity curve, the more reliable the trader is. If you look at the blue line on this image here, you’ll see that it’s jagged up and down all over the place. You’ll typically see this where a trader is using a larger amount of risk. As I mentioned, could be 2%, could be 5, could be 10%. You’ll see rapid swings up and down. Overall they’re profitable, but the deviation is quite large in the swings. If you look at the green line, you’ll notice that it goes straight up. That would be the ideal situation. I mean, no trader ever hits that. However, how you get closer to that is by placing many more trades and using a much smaller risk per trade.

Leave A Comment