Currency trading can be risky. And for a lot of people, unfortunately, this is where they stop. They hear the word risk and they run away and they don’t look at the investment as a proper investment vehicle because they hear the word risk. Which is quite unfortunate because many smart investors will take the time to understand what are the specific risks and how do you mitigate those risks? Because there is opportunity there. And if you can learn how to control the risk, it increases the chance of an investment, not just foreign exchange, but any investment being more fruitful. So in this video, I’m going to go through how we think about risk, what the risks are and how we mitigate them. So you can properly be informed if this type of investment would be right for you or not. There are two types of risks when it comes to any investment.

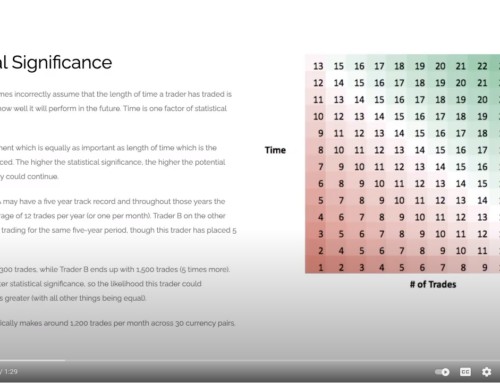

The first type is the loss of capital. Investing a bad investment, and it goes pear shaped. We lose capital. The other one is the hidden one, which most people don’t consider when looking at an investment option, which is the opportunity cost or is the opportunity cost of not pursuing an investment because you are you’re equipped or ill informed about the potential of it and the risks of that investment. The opportunity costs can often be multiple times larger than the risk of investing in the first place. And being an intelligent investor, you already know that it’s not about what is the return of investment. It’s not about what is the risk of an investment in isolation. It’s about the combination of what is the probability of this investment will payoff versus the risk that we’re willing to risk. And what is the potential payoff if it works?

Leave A Comment